The Best Guide To Mileagewise - Reconstructing Mileage Logs

The Best Guide To Mileagewise - Reconstructing Mileage Logs

Blog Article

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Buy

Table of ContentsMileagewise - Reconstructing Mileage Logs - The FactsThe 9-Second Trick For Mileagewise - Reconstructing Mileage LogsFascination About Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs Can Be Fun For AnyoneAll About Mileagewise - Reconstructing Mileage LogsThe Best Guide To Mileagewise - Reconstructing Mileage LogsThe Greatest Guide To Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Distance function recommends the shortest driving course to your staff members' location. This attribute improves performance and adds to set you back financial savings, making it an essential asset for businesses with a mobile workforce.Such a method to reporting and conformity streamlines the often complicated task of handling mileage expenditures. There are several advantages related to using Timeero to keep an eye on mileage. Let's take an appearance at a few of the app's most remarkable features. With a trusted gas mileage monitoring device, like Timeero there is no demand to bother with inadvertently leaving out a day or piece of information on timesheets when tax obligation time comes.

A Biased View of Mileagewise - Reconstructing Mileage Logs

These additional verification measures will maintain the Internal revenue service from having a reason to object your mileage documents. With accurate mileage tracking technology, your staff members do not have to make harsh gas mileage estimates or even worry about mileage cost monitoring.

If an employee drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all automobile expenditures (free mileage tracker). You will certainly need to proceed tracking gas mileage for work even if you're utilizing the real expense approach. Keeping mileage documents is the only means to different organization and personal miles and offer the proof to the IRS

A lot of mileage trackers allow you log your trips manually while computing the range and repayment quantities for you. Several additionally come with real-time trip tracking - you require to begin the application at the beginning of your journey and stop it when you reach your final destination. These apps log your start and end addresses, and time stamps, together with the overall distance and reimbursement amount.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

This includes expenses such as gas, upkeep, insurance, and the automobile's devaluation. For these costs to be thought about insurance deductible, the car needs to be made use of for company functions.

The Main Principles Of Mileagewise - Reconstructing Mileage Logs

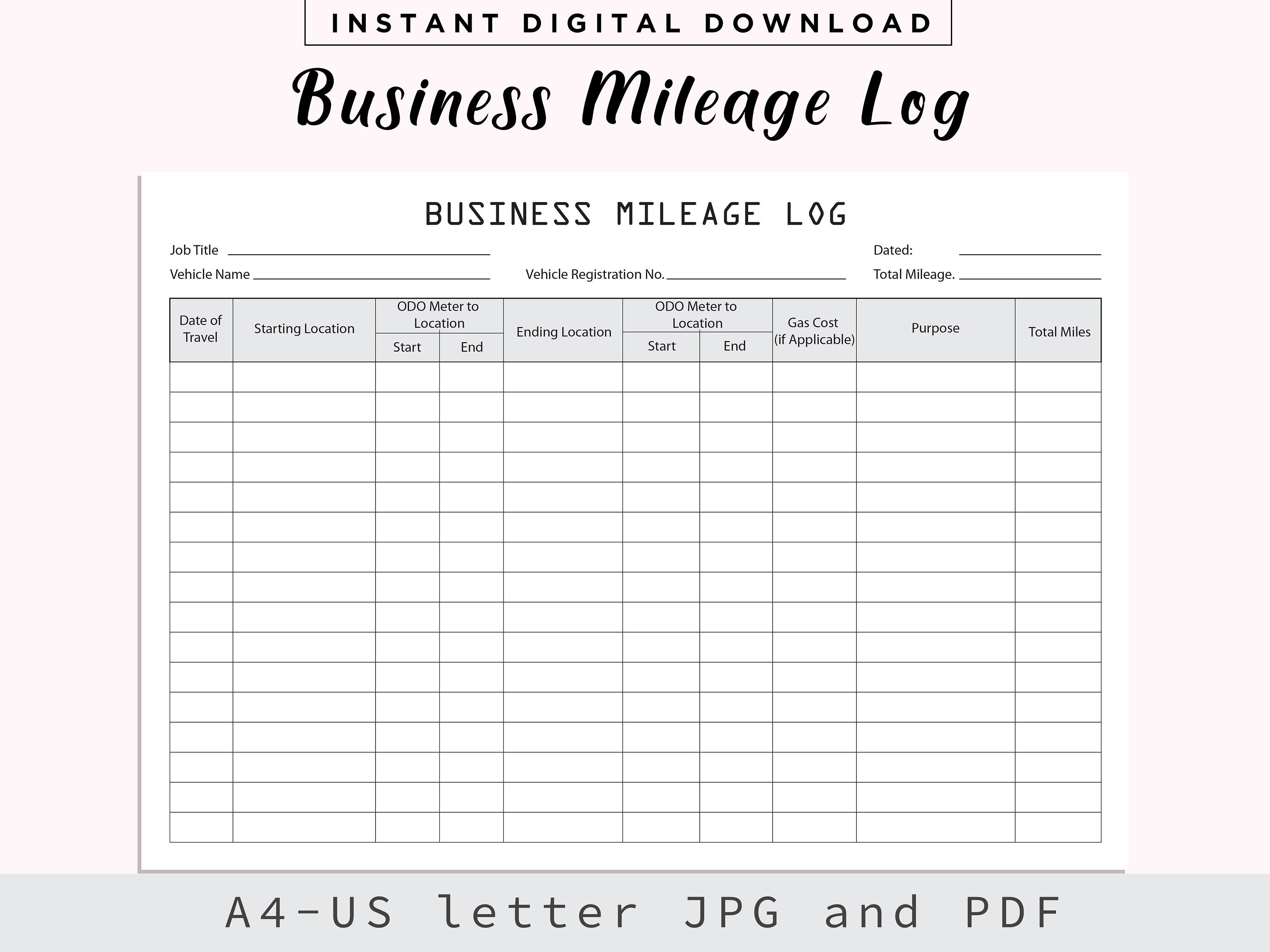

In between, diligently track all your service trips keeping in mind down the beginning and ending analyses. For each trip, document the location and organization function.

This includes the overall business gas mileage and overall gas mileage accumulation for the year (organization + personal), journey's date, location, and function. It's vital to videotape tasks promptly and preserve a coeval driving log outlining day, miles driven, and business function. Right here's just how you can improve record-keeping for audit objectives: Start with making sure a meticulous her response mileage log for all business-related traveling.

Mileagewise - Reconstructing Mileage Logs - Truths

The actual costs method is an alternative to the common gas mileage price technique. Rather of determining your deduction based on a predetermined price per mile, the real expenditures approach allows you to subtract the real expenses connected with using your car for company purposes - mileage log. These costs consist of gas, maintenance, repair work, insurance, depreciation, and various other relevant costs

Those with considerable vehicle-related expenses or distinct problems might profit from the real expenses approach. Ultimately, your selected approach ought to straighten with your specific monetary objectives and tax circumstance.

Mileagewise - Reconstructing Mileage Logs for Beginners

(https://www.reverbnation.com/artist/mileagewisereconstructingmileagelogs)Compute your overall service miles by utilizing your begin and end odometer analyses, and your videotaped organization miles. Accurately tracking your exact mileage for organization journeys help in validating your tax obligation deduction, especially if you opt for the Criterion Mileage technique.

Keeping track of your mileage manually can need persistance, but remember, it might save you cash on your tax obligations. Tape-record the total mileage driven.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

In the 1980s, the airline company market became the initial business users of general practitioner. By the 2000s, the shipping market had actually adopted general practitioners to track plans. And currently virtually everybody makes use of general practitioners to navigate. That implies almost everyone can be tracked as they tackle their business. And there's snag.

Report this page